Travel ETFs Hold On To Strong YTD Returns - ETF Trends

Despite volatility and chaos in markets in March, travel ETFs have largely held onto their year-to-date gains.

Travel ETFs have been supported by strong demand for leisure travel couples with higher prices. Despite recession fears ushering in concerns about consumer spending, U.S. airlines have largely been bullish about 2023 travel demand.

Cruise operators including Carnival, Royal Caribbean Group, and Norwegian Cruise Lines Holdings have reported resilient demand from cooped-up consumers undeterred by elevated inflation as COVID-19 pandemic-related restrictions ease, Reuters reported.

Quality screening across diversified global travel stocks has begun to separate the ALPS Global Travel Beneficiaries ETF (JRNY) from other travel-focused strategies. JRNY is outpacing its competitors and broader global markets year to date.

“The consumer has been quite resilient and willing to spend for travel and leisure despite persistently high inflation,” Todd Rosenbluth, head of research at VettaFi, said. “There’s positive sentiment toward the stocks inside JRNY.”

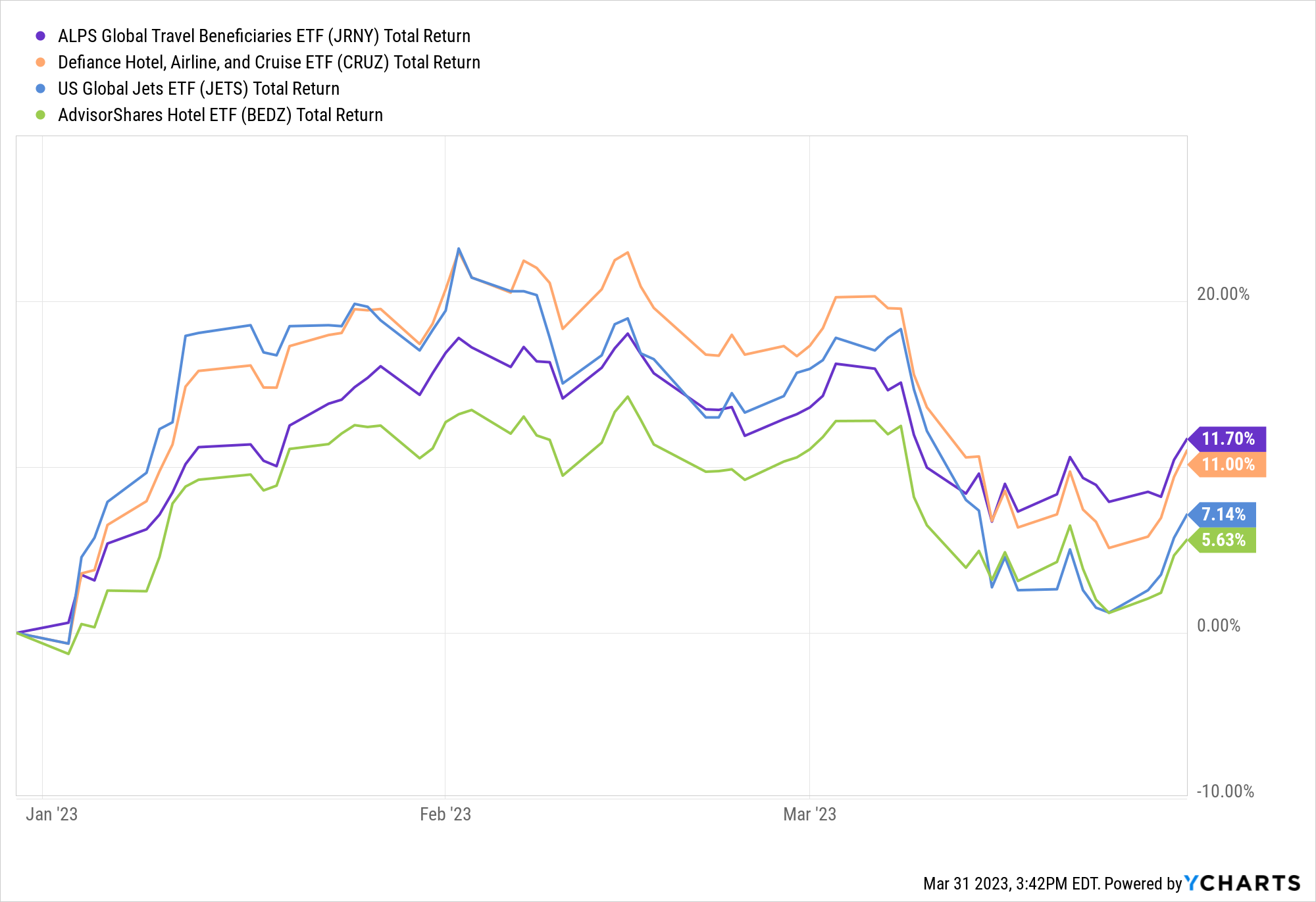

JRNY climbed 11.7% year to date as of March 30, while the AdvisorShares Hotel ETF (BEDZ) gained 5.6%, the Defiance Hotel Airline and Cruise ETF (CRUZ) increased 11.0%, and the U.S. Global Jets ETF (JETS) rose 7.1%. The S&P 500 increased 6% on a total return basis during the same period.

JRNY, which tracks the S-Network Global Travel Index (TRAVEL), offers access to a broad global travel ecosystem and other travel beneficiaries to provide holistic exposure to secular tailwinds in global travel.

JRNY is composed of 79 holdings as of March 31, with its top holdings currently including LVMH Moet Hennessy Louis Vuitton SE (MC), Booking Holdings Inc. (BKNG), Estee Lauder Companies Inc (EL), Walt Disney Company (DIS), and Airbnb Inc (ABNB), according to ETF Database.

The fund invests in companies principally engaged in, or deriving significant revenue from, the global travel industry, including four segments: Booking & Rental Agencies, Airlines & Airport Services, Hotels, Casinos & Cruise Lines, and Global Travel Beneficiaries.

For more news, information, and analysis, visit the ETF Building Blocks Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for JRNY, for which it receives an index licensing fee. However, JRNY is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of JRNY.

from "travel" - Google News https://ift.tt/GqOF4ED

via IFTTT

Comments

Post a Comment